YONSEI-EU Jean Monnet Centre

EU와 ASIA를 연결하는 네트워크 허브

EU 동향

EU 관련 최신 현안 이슈 및 동향을 분석하고 시사점을 제시합니다.

The Draghi Report: ECB’s Vision to Revitalize the EU’s Economic Viability

The Draghi Report, authored by Mario Draghi, the former president of the European Central Bank (ECB), proposes an ambitious and detailed plan for fiscal consolidation as a breakthrough for Europe’s current economic stagnation and its potential risk of losing its competitive edge.

Highlighting the necessity of defying the EU’s existing practices in business and politics, which are identified as hindrances to the region's growth, the plan emphasizes the urgent need for change and innovation through cohesion and cooperation among the European Union’s member nations.

In today’s brief, the ambition and goals of the plan will be examined in terms of their realism and potential impact on the EU’s future and the global market landscape amidst rapid shifts in global politics, diplomacy, and related dynamics.

[Short Ends of EU’s Strict Regulations]

The European Union (EU) is renowned for its strict and often pioneering regulations, such as Corporate Social Responsibility (CSR) requirements and refugee-friendly policies. While initiatives that support these regulations are intended for the greater good, they have not always been conducive to industrial development. [1]

Take Unicorn Ventures as an example. Due to strict IPO regulations and tax laws, about 30% of EU-based unicorns have relocated to the U.S. [2] The EU’s high moral standards for businesses often fail to offer a fertile environment for start-ups to thrive. The challenges do not end there. The EU’s stringent regulations, Draghi explains, have deterred the growth and evolution of existing and established businesses as well. In contrast, China’s fast-growing industries across different sectors, which often face little to no legal restrictions and benefit from state-driven supports, have grown to the point it started threatening the traditional superpowers in the west. This divergence insinuates how the EU’s current grappling situation may jeopardize maintaining its former glory.

[Potential for Recovery Through Sustainability]

Yes, it is only natural to expect slower economic growth by putting sustainability to the forefront, given how this era is still heavily reliant on fossil fuels. How the EU has been in the center of human rights, environmental protection, and equity initiatives is commendable and makes it the global leader in these areas, undoubtedly. Even though these come at a cost to the EU’s economic momentum, the table can turn rapidly. As green energy and green business practices become the new normal, the EU might recover its economic vitality in a matter of time, leading the global transition.

As a result, the Draghi plan indicates that alleviating rules will increase the driving force behind corporate evolution and expansion. Aligning with that, he did not neglect to point out how the spirit of fostering a greener future should remain at the heart of the community, regardless of whether the limits are lifted. That said, EU’s pursuit and efforts for sustainability will persist.

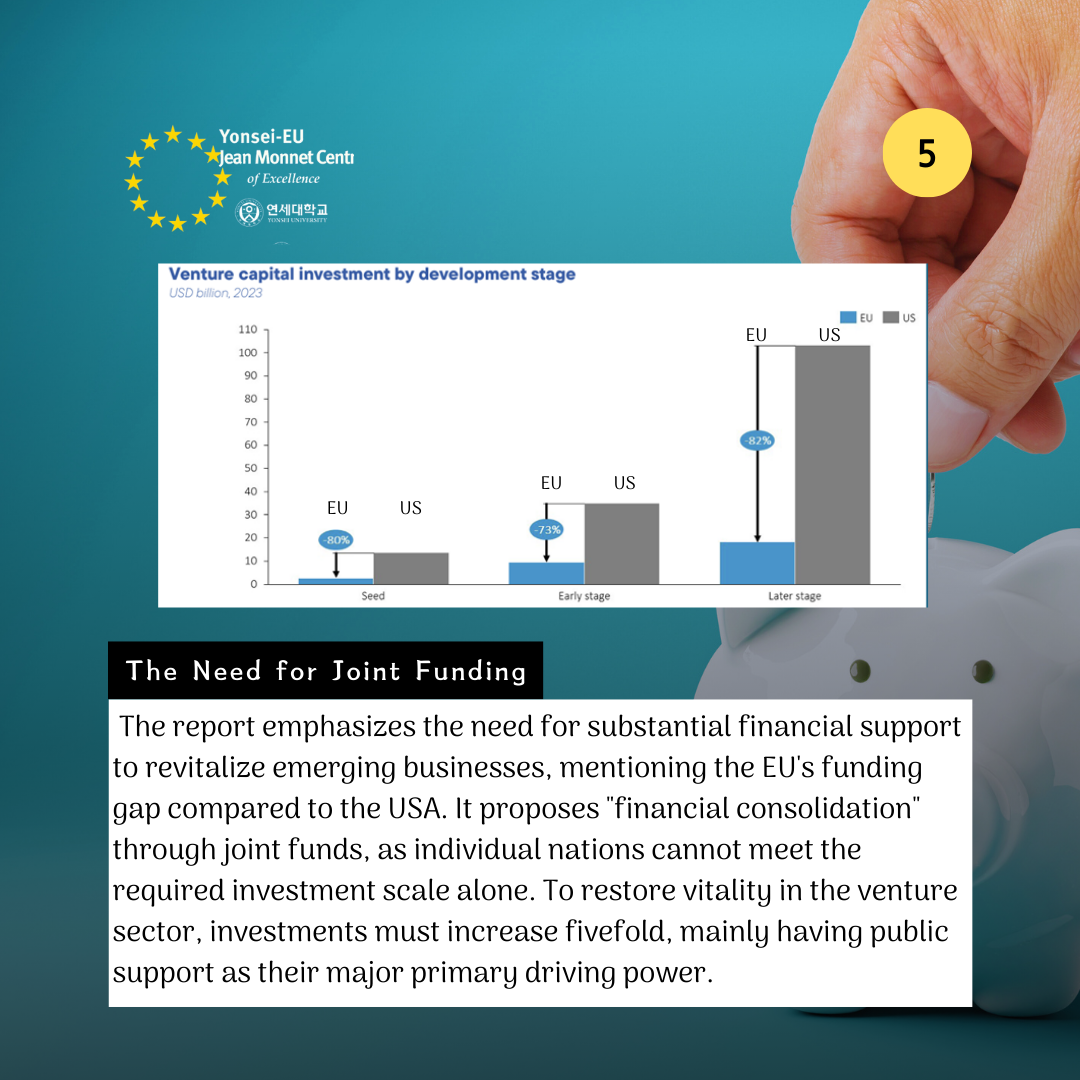

[The Need for Joint Funding]

Another thing the report has pointed out is that there is not enough funding for emerging businesses. To implement the plan, massive amounts of financial support are indispensable. Without public funds, it is deemed impossible for private sectors to bear the lion’s share of financing investments. Therefore, the plan suggests “financial consolidation” or joint funds in the Eurozone Area.

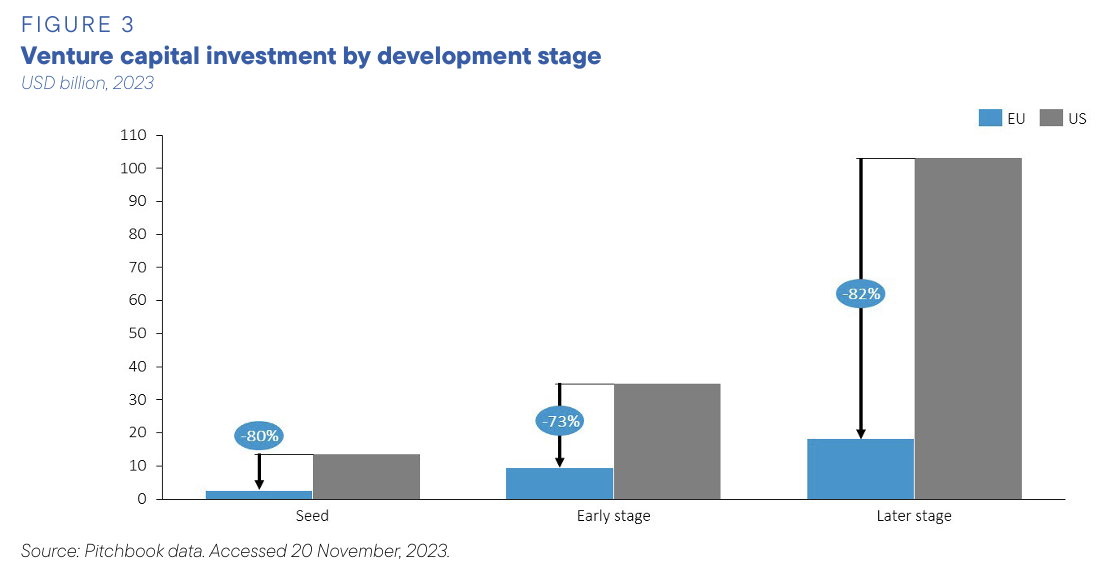

What is the rationale behind the merger of financial endeavors? It is due to two major factors. To begin, the investment should not be doubled or tripled. It needs a quintuple!! Yes, five times more to restore its vitality in the venture sector! This is closely related to the other reason why consolidation is required: a single nation cannot do so, and in a single market economy, assisting nations to aid nations will be essential.

[Exhibit1] Venture Capital Investment by Development Stage (source: Mario Draghi. (Sep 2024))

Draghi and the ECB highlighted that the Euro Area has been lagging in funding across both private and public sectors compared to major competitors like the USA and China. To address the disparities created over the last decade, bold investments are essential.

[How Realistic Is the Plan?]

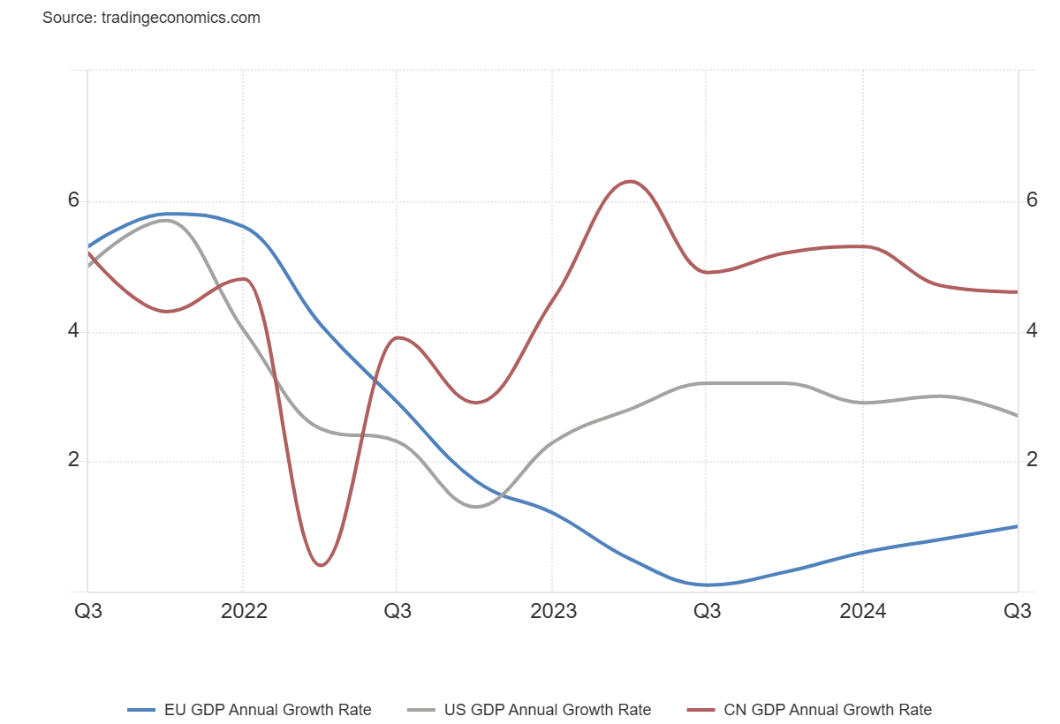

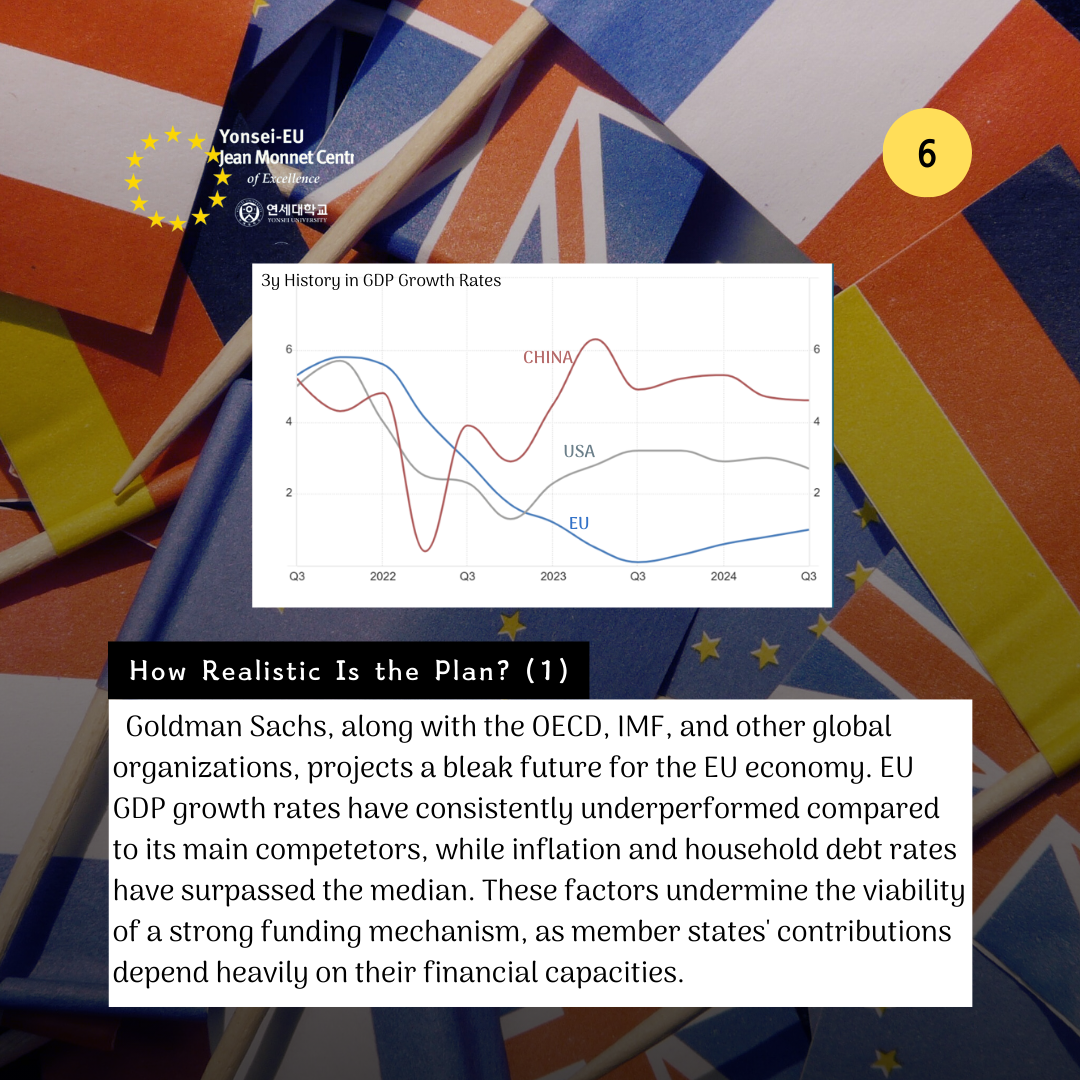

According to Goldman Sachs, the future of the EU economy is not very positive. It’s not just GS, but also the OECD, IMF, and other prestigious global financial corporations and organizations projecting the same prognosis.

[Exhibit 2] 3y History in GDP Growth Rates (Source: tradingeconomics.com)

For financial consolidation, while it is necessary to suggest convincing mechanisms to encourage member nations to contribute, participation in the fund ultimately depends on each nation’s financial capability. Meanwhile, with the EU's GDP growth rate falling far below the global average and its inflation rates and household debt increase rates exceeding the median, the prospect of a strong driving force for the funding mechanism remains bleak.

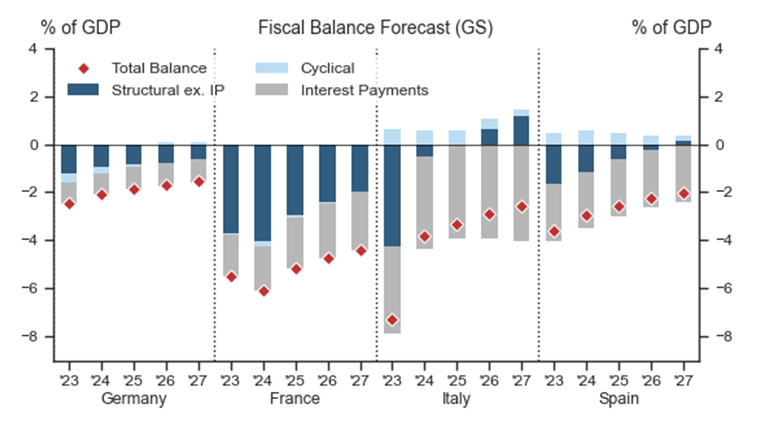

[Exhibit 3] Shrinking Deficits and Structural Consolidation

(Source: Goldman Sachs Global Investment Research, Haver Analytics)

Nevertheless, the most important factors and key players are the EMU-4 countries—the European Union’s Big Four: France, Spain, Germany, and Italy. They have been fiscally consolidated and is anticipated to continue for the next three years, said Goldman Sachs. While Spain and Italy are expected to recover from protracted stagnation alongside the transition from debt-heavy states to more stable government treasuries, France and Germany, in contrast, are facing economic downturns driven by high unemployment rates and many other factors. [3] Especially, this discrepancy is raising fears of subsidizing weaker member states, among “frugal” states, such as Germany. [4]

The plan strongly emphasizes the need to "level" the playing field in competition by addressing China's competitive pricing policies, backed by state-support mechanisms. This, coupled with the EU’s upcoming enactment of the Carbon Border Adjustment Mechanism (CBAM), implies a strategic pivot to reduce dependency and enhance fair competition. China and its close stakeholders will have to harness themselves with backfires for the EU’s run to economic independence.

Additionally, investment sectors in the EU are expected to bloom, as the plan stresses the necessity of multiplying the investment-to-GDP ratio by five times—an unprecedented move since the late 1970s—to maintain its innovative edge. [5] The plan’s goal is clear: to prevent further losses of "unicorn" companies and lucrative businesses to the United States, ultimately retrieving its former glory as an economic powerhouse. While the recommendation to quintuple investment inflows is ambitious, it is likely to fall short of this target, given the EU’s relatively static economic situation. Nonetheless, it is reasonable to expect much livelier dynamics in investment and venture capital markets as a result.

[Author’s Hot Take]

If you’ve got a passion for climate tech ventures—or just any venture, especially if it’s tied to AI or cutting-edge technologies—you might find some great funding opportunities and room to grow your business in the Eurozone Area. It’s not just the USA offering the “American Dream” anymore; the EU is stepping up to give future innovators their shot at a “European Dream” too.

kimeunjeong387728@gmail.com

[1] Bob Savic. (Oct 2024). EU aims to boost competitiveness at long last. GIS Reports – Economy. https://www.gisreportsonline.com/r/eu-commission-economic-competitiveness/

[2] European Investment Bank (Jan 2024) The scale-up gap: Financial market constrains holding back innovative firms in the European Union. Economics – Thematic Studies. European Investment Bank.

[3] Filippo Taddei, Alexandre Stott, Francesco Coppola. (2024, October 14). Euro Area Fiscal Policy—Continued Consolidation and Debt Decoupling. Goldman Sachs.

[4] Jack Schickler (Sep 2024). Draghi calls for EU common borrowing, end to national vetoes to compete with China, US. Euronews. https://www.euronews.com/my-europe/2024/09/09/what-is-the-long-awaited-draghi-report-on-eu-competitiveness

[5] Mario Draghi. (Sep 2024) The future of European competitiveness – A competitiveness strategy for Europe. European Central Bank, European Commission.