YONSEI-EU Jean Monnet Centre

EU와 ASIA를 연결하는 네트워크 허브

EU 동향

EU 관련 최신 현안 이슈 및 동향을 분석하고 시사점을 제시합니다.

Current Trends and Future Forecast on EUR-USD Exchange Rates and Forex Markets

The Foreign Exchange (Forex) market, the largest financial market in the world, plays a critical role in enabling currency conversions for international trade and investment. Among the most closely watched currency pairs is the EUR-USD, which has traditionally hovered around 1 euro = 1.13 USD. However, this exchange rate is anything but static, often shifting in response to a complex mix of economic and geopolitical forces.

Take February 2022, for instance. The onset of the Russia-Ukraine war sent shockwaves through global markets, leading to an instant depreciation of the euro and a simultaneous appreciation of the U.S. dollar. Geopolitical tensions and economic uncertainties in Europe caused investors to abandon riskier assets, favoring the perceived stability of the USD. This shift was further amplified by the U.S. Federal Reserve's aggressive interest rate hikes, which added to the dollar's strength. By September 2022, the EUR-USD exchange rate hit a low of approximately 1 euro = 0.96 USD—a level not seen in nearly two decades.

Such fluctuations underscore the intricate and ever-changing nature of the Forex market, where macroeconomic policies, global events, and market sentiment are all inextricably linked. In this week’s brief, we’ll take a closer look at the EUR-USD Forex market over the past five years, examine its current trends, and consider what the future might hold in this highly dynamic financial arena

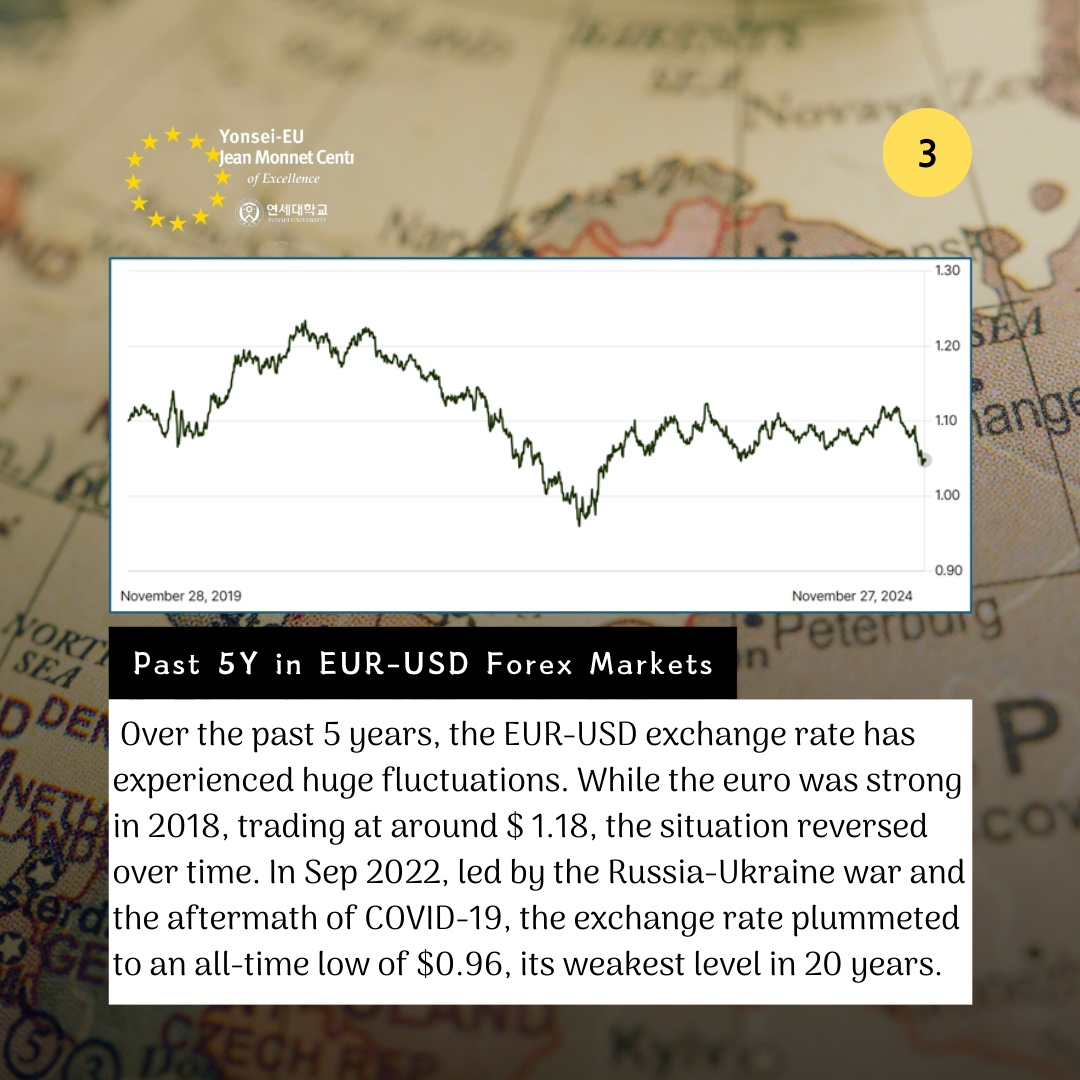

[Past 5 years in EUR-USD Forex Markets]

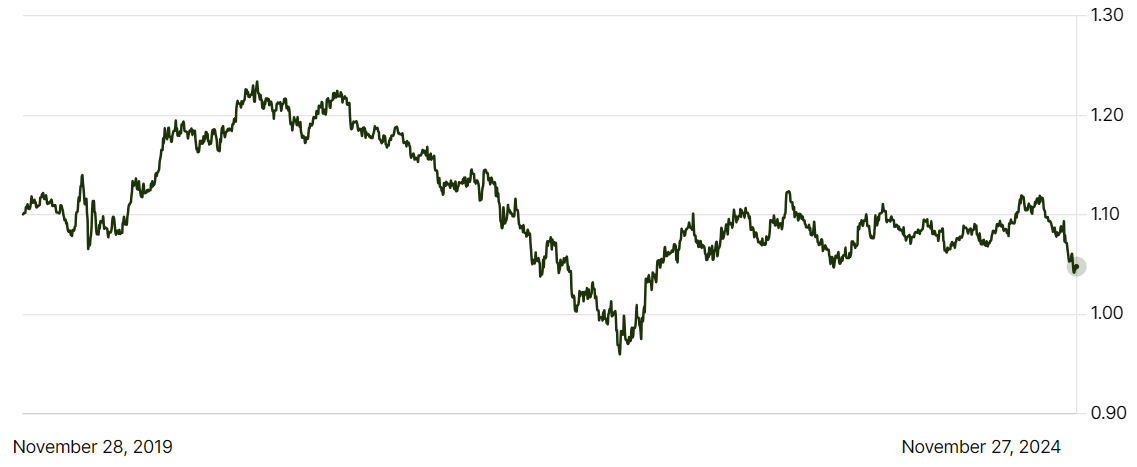

Over the past five years, the EUR-USD exchange rates had its up’s and down’s. In 2018, the euro was relatively strong, trading at around 1.18 USD. Since then, a combination of factors—including divergent monetary policies between the ECB and the U.S. Federal Reserve, standard interest rates discrepancies, and other different things—has affected fluctuations in the exchange rate.

By November 2024, the rate has dropped to approximately 1 euro = 1.04 USD, further proving the continued strength of the U.S. dollar. This level is particularly striking, as it matches the rate seen in February 2022 when the Russia-Ukraine war began, signaling a persistent pressure on the euro and the evolving dynamics in the Forex market.

[Exhibit 1] 5 years history in EUR-USD Exchange Rate (source: wise.com)

[Current Trends in EUR-USD Forex Market]

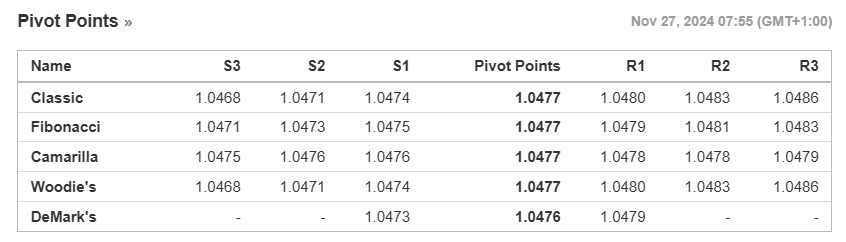

For the last month, the trend in EUR-USD was a strong sell market for USD holders. There are many different useful indicators and factors, but this in this week’s brief, the Pivot Point will be used as a measure of EUR-USD exchange rate and market trends.

- Pivot points for EUR-USD: Technical indicators

Pivot points**, along with support and resistance levels, are considered one of the simplest yet most effective tools in technical trading. These indicators are widely trusted by traders, banks, and financial institutions as they provide clear insights into market strength and weakness. The pivot point represents the level where market sentiment shifts between bearish and bullish trends. For EUR-USD, the pivot point, as of November 27, is calculated at 1.0477.

[Exhibit 2] Pivot Points Chart for EUR-USD Forex as of Nov 27 (source: investing.com)

Note1: Pivot Point Formula: PP = (High + Low + Close)/3. Difference in adopted methodology, though sharing the same baseline, may induce slightly varying values.

- Implications of the Pivot Point at 1.0477

The purpose of referring to pivot points is to use it as an indicator. For example, if the EUR-USD exchange rate approaches a certain level, USD holders might consider transitioning from selling to buying euros, as it could indicate a potential market reversal.

Historically, pivot points for EUR-USD have ranged between 1.10 and 1.20**, from which we can assume the current lower value as a sign of the USD’s relative strength. The current PP at 1.0477 reinforces a “Strong Sell” recommendation for EUR holders at current levels. When it comes to ‘Sell’ or ‘Buy’ recommendations, a ‘Sell’ means that euro is likely to weaken so it is advantageous to sell and vice versa for a ‘Buy’.

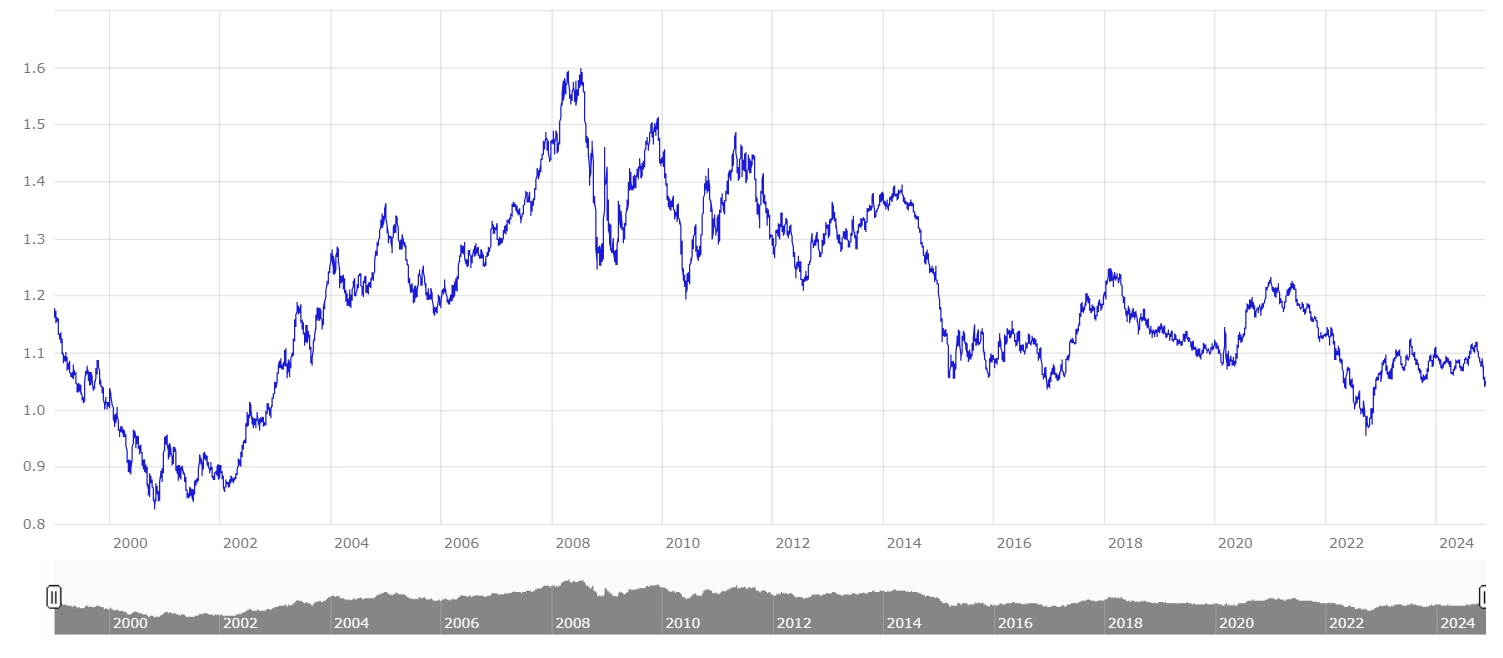

[Exhibit 3] EUR-USD exchange Rates. (source: ECB Euro system)

Note2: the number of 1.10 – 1.20 is an estimated value, given the historical EUR-USD Forex rates for almost 3 decades.

[Why Is the EUR Weak While the USD Is Strong?]

Several factors have contributed to the recent strong sell market in EUR-USD Forex streams. When it comes to identifying the most important and impactful factors in exchange rates must be ‘Interest Rates’ and ‘Inflation Rates’. Taking to compare those of EU’s to US’s, with other minorly relevant factors as well.

-

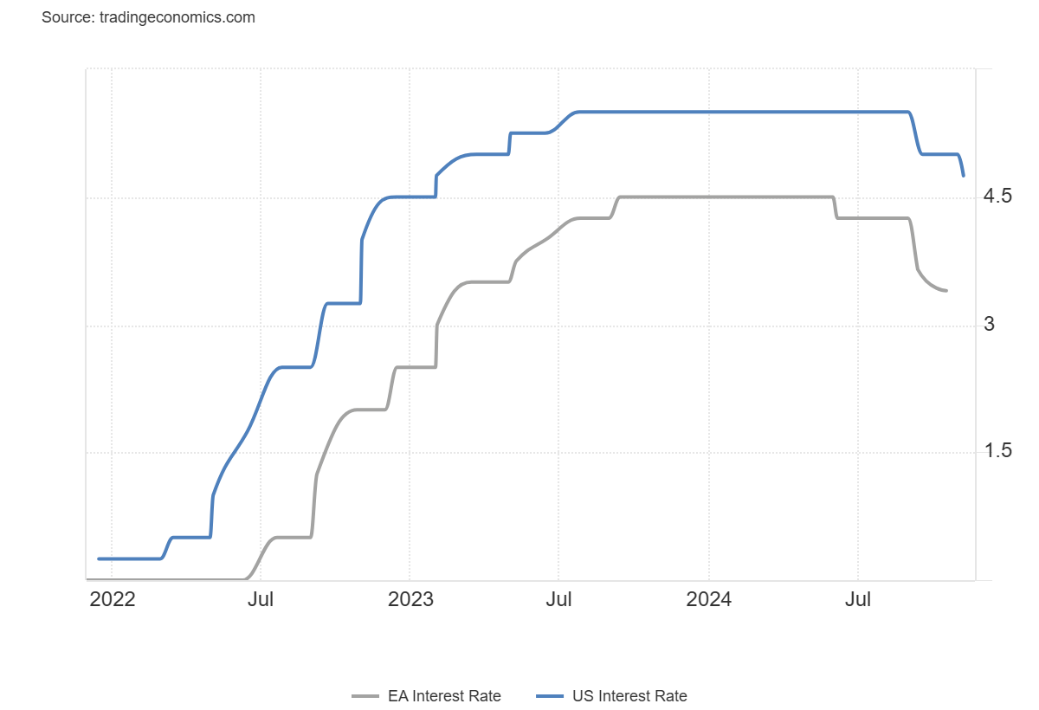

- Interest Rate Differentials: The European Central Bank (ECB) has maintained its main refinancing operations rate at 3.40%, while the U.S. Federal Reserve's federal funds rate stands at 4.5%–4.75%. Higher U.S. interest rates attract investors seeking better returns, bolstering the USD's strength relative to the euro.

[Exhibit 4] Interest Rate 3Y Comparison between Euro Area (EA)-US (source: tradingeconomics.com)

-

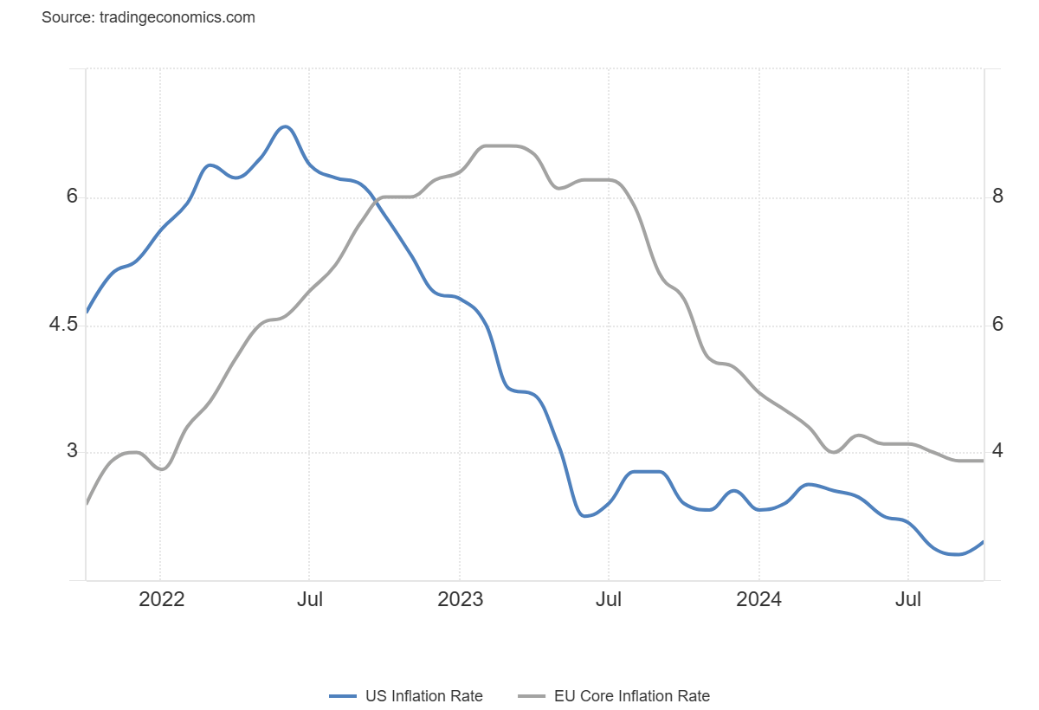

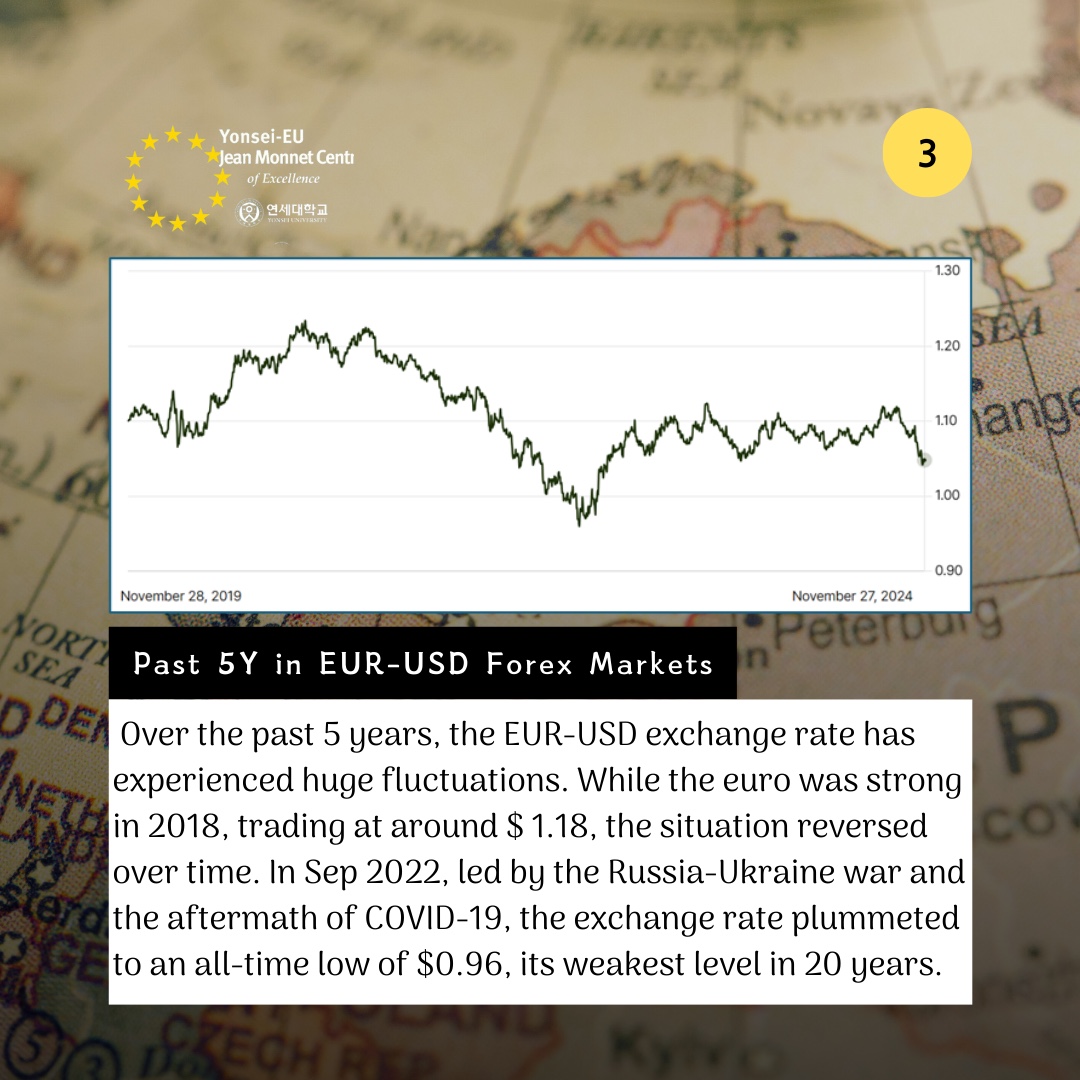

- Both the Eurozone and the U.S. have faced significant inflationary pressures due to factors during and after the COVID-19 pandemic’s aftermath. The U.S. implemented aggressive interest rate hikes to combat inflation, while the ECB adopted a more cautious approach. Partly due to this difference in strategies, by September 2022, the inflation rate dynamics between the two regions were reversed, with the Euro Area (EA) consistently showing higher rates than the U.S. ever since.

[Exhibit 5] Inflation Rate 3Y Comparison between EA-US (source: tradingeconomics.com)

-

- Geopolitical Tensions: The Russia-Ukraine conflict has introduced economic uncertainties, particularly affecting Europe. Investors have sought the relative safety of the USD, contributing to its appreciation against the euro.

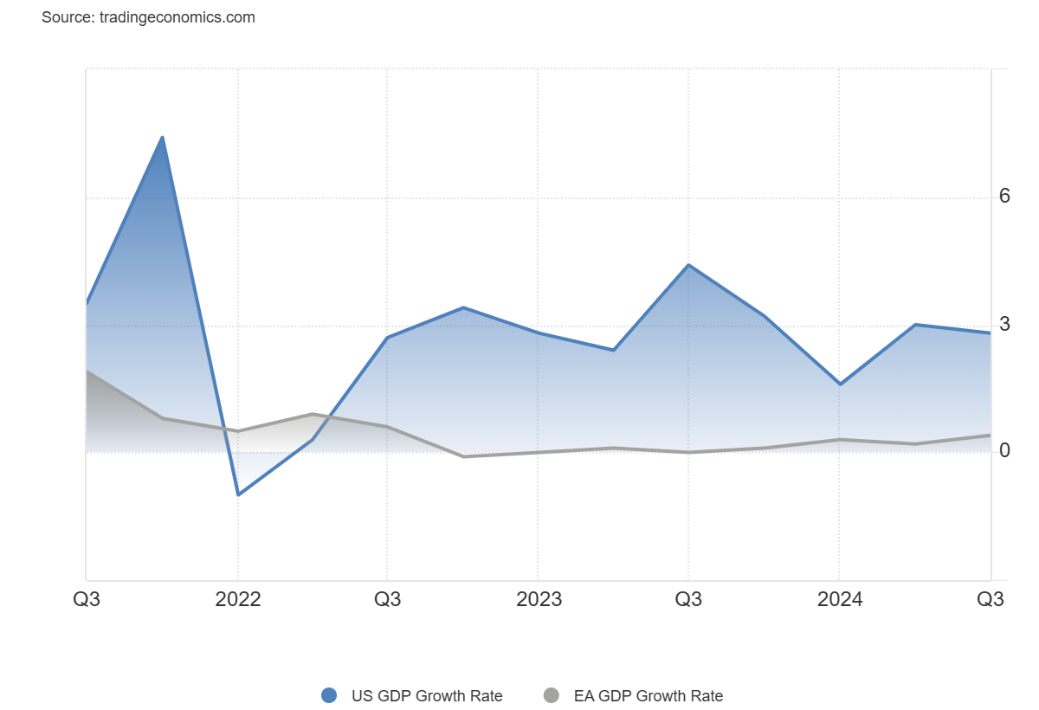

- Economic Growth Disparities: The U.S. economy has demonstrated better growth compared to the Eurozone, influencing investor confidence and currency valuations. Except the first 2 quarters in 2022, USA’s GDP Growth Rate (GGR) maintains exceeding that of EU’s

[Exhibit 6] GDP Growth Rate 3Y Comparison between EA-US (source: tradingeconomics.com)

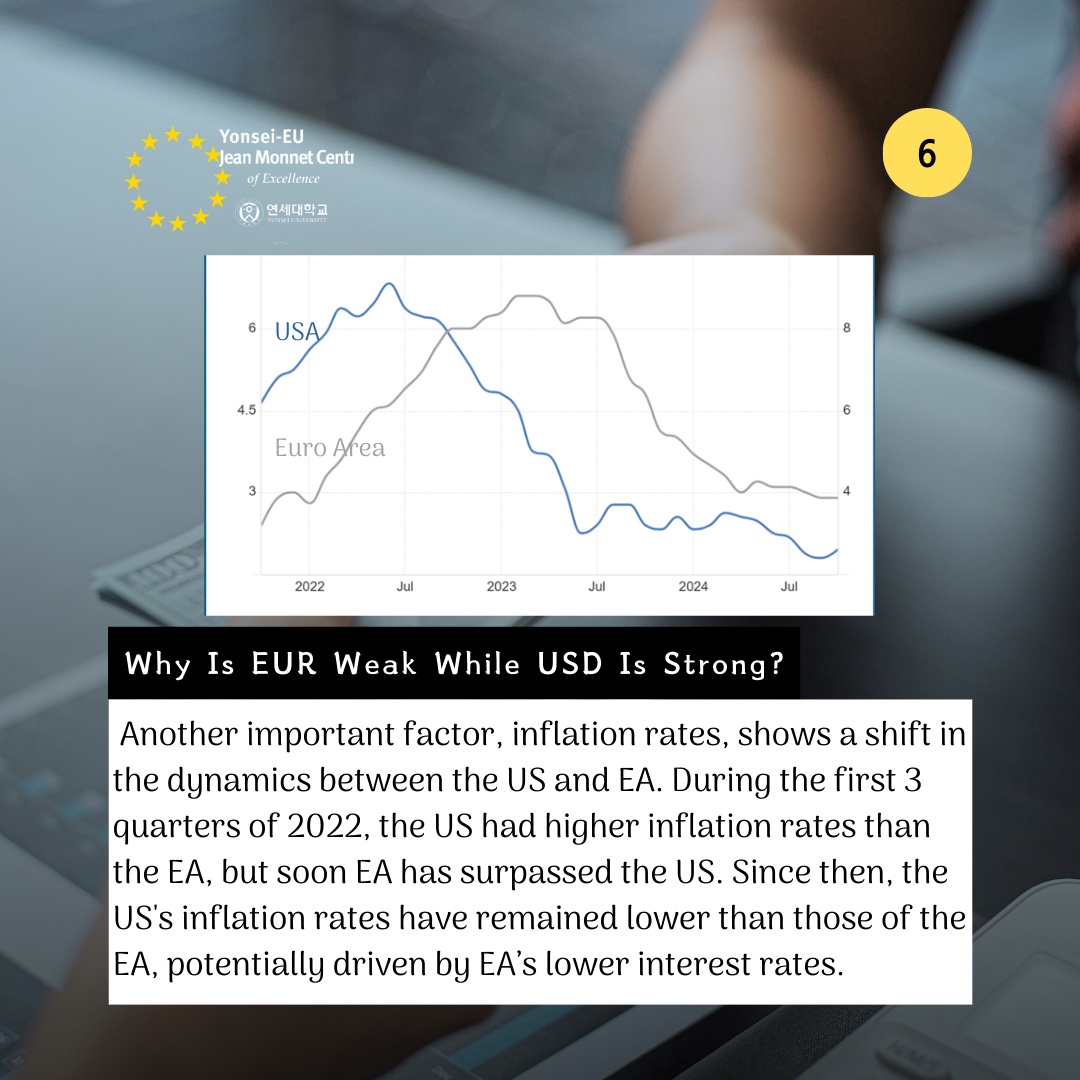

[EUR-USD Forex Trends and the Impacts]

The current "Strongly Sell" trend in the EUR-USD Forex market reflects the USD’s strength and the Eurozone’s vulnerabilities. This trend not only means that but also there will be other by-products of the rate differences.

- Further Inflation: A weaker euro raises import costs, particularly for energy and raw materials, driving inflation and straining European businesses. On the bright side, exporters may benefit as European goods become cheaper for foreign buyers, bringing some revenues back to the EA region.

- Weakening of Domestic Investment: The strong dollar attracts capital to the U.S., while European investors seek higher returns abroad, contributing to capital outflows from the Eurozone, weakening the domestic investing markets.

- Withering Consumer Power in EA: A weaker euro means reduced purchasing power within Europe, which could potentially further drive the stagnancy in economic growth.

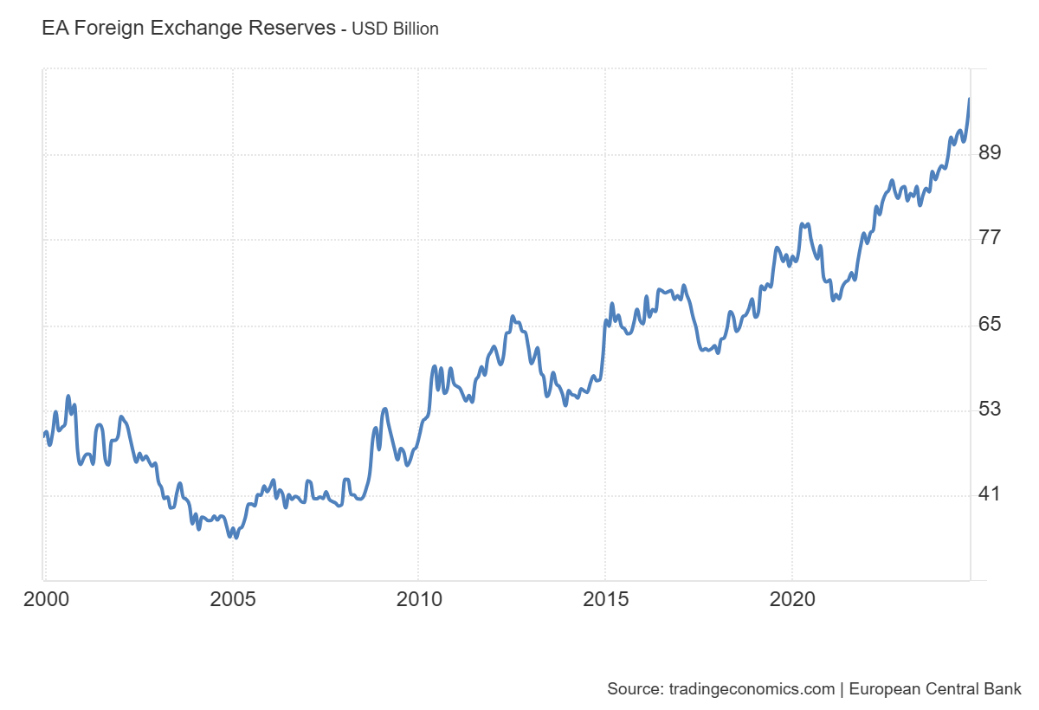

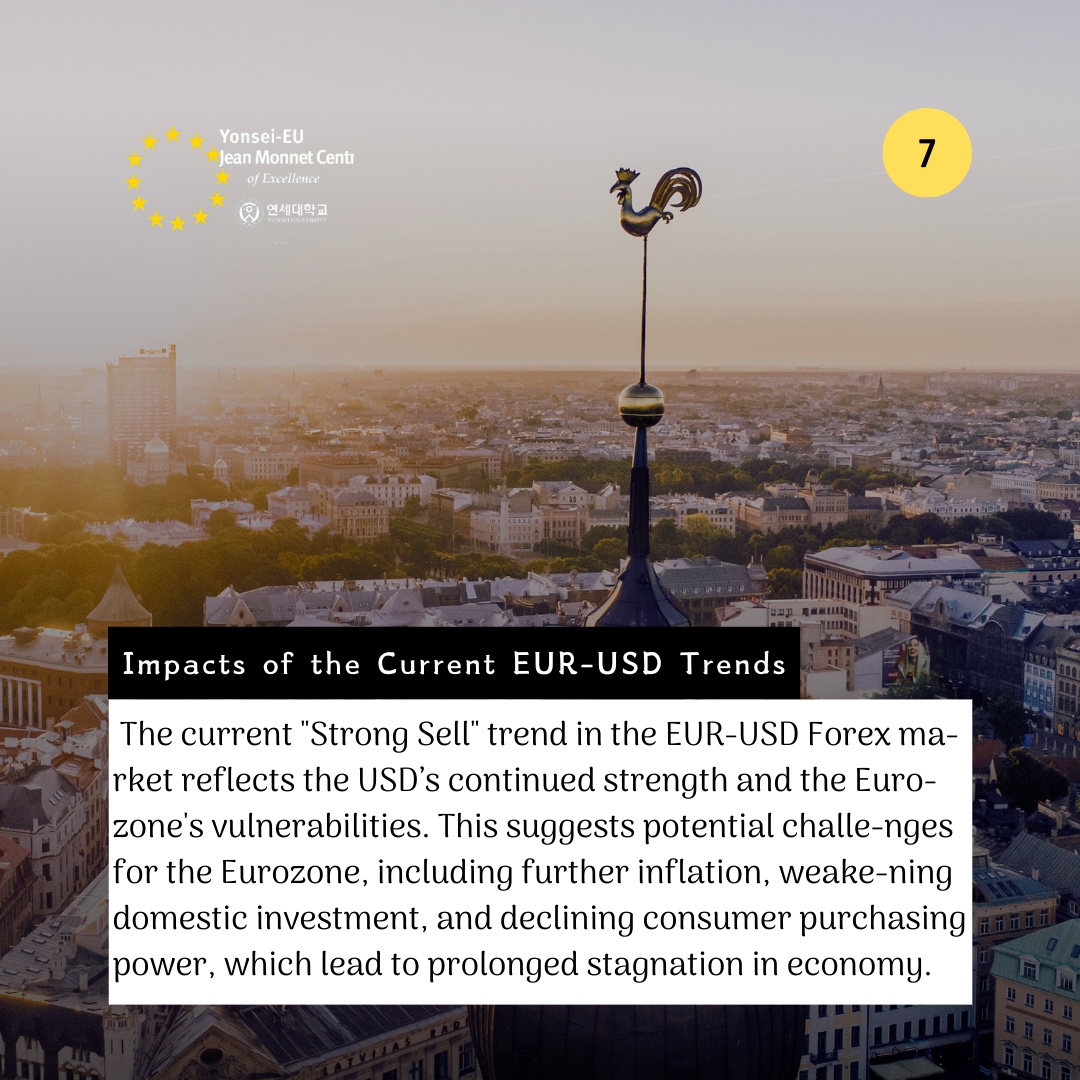

Intertwined with many factors in society and economy, the current situation is impacting Europe’s economy -not so much in a good way. However, in fact, the EU’s strong reserve in foreign exchange is preventing the worst-case scenarios, giving it the much needed breathing room, effectively mitigating the negative effects of undervalued Euros.

According to the European Central Bank (ECB), Foreign Exchange Reserves In the Euro Area increased to 96.82 USD Billion in October from 92.81 USD Billion in September of 2024. Foreign Exchange Reserves in Euro Area averaged 58.35 USD Billion from 1999 until 2024, reaching an all-time high of 96.82 USD Billion in October of 2024 and a record low of 34.91 USD Billion in February of 2005. [1]

[Exhibit 7] EA Foreign Exchange Reserves (source:tradingeconomics.com l ECB)

[Forecast: Not Very Sunny]

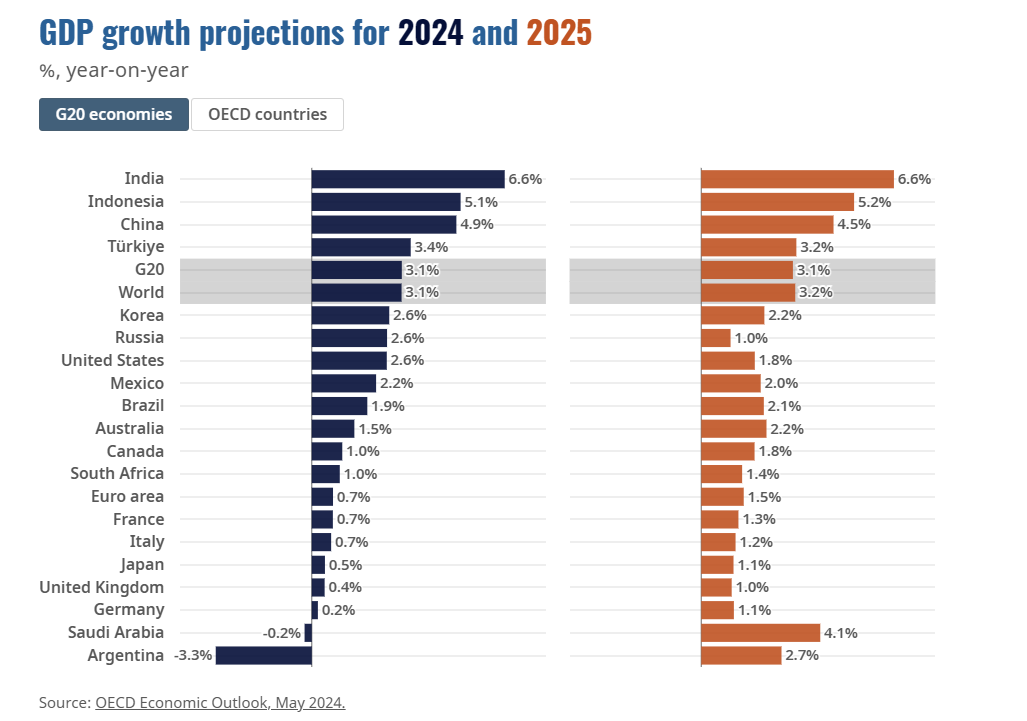

Long story short, current trends in EUR-USD Exchange Rate and Forex market is very likely to persist. According to a Goldman Sachs report, the European fiscal stance is projected to remain negative until 2027, an improvement from 2024, yet still exerting a drag on growth by approximately 0.3 percentage points per annum. [2] The OECD’s report has shown the tangible markers of Europe's sluggish or stagnant economic growth at 0.7% in 2024, notwithstanding the G20 average at 3.1%. Gladly, there will be an upturn by 100% at 1.5% in 2025, but that is still at the half of the global average.

[Exhibit 8] GDP growth projections for 2024 and 2025 (source: OCED Economic Outlook)

Although Reuters reports that inflation in the Eurozone is expected to slow to 2.2%, [3] the combination of fiscal challenges and the forthcoming Draghi plan’s unpromised success cannot ensure the EU’s upturn in the current situation.

While the forecast for the EUR’s value appears rather bleak, there are a few factors to consider regarding Europe’s financial landscape. Firstly, the Draghi Plan. The plan, named after ECB’s former chief Mario Draghi, aims to secure financial stability within the EU and promote fiscal consolidation across the region. Its goal is to foster a unified fund for more effective financial planning. Goldman Sachs has expressed concerns about the plan, describing it as “vague” and cautioning that “regardless, the economy will stay stagnant.” [1] However, if the plan succeeds in inducing a positive upturn in the situation, it would not be irrational to anticipate a higher valuation of the EUR in the future, potentially restoring its former strength.

Secondly, the CBAM regulations. The EU’s Carbon Border Adjustment Mechanism (CBAM) is set to take full effect in 2026. However, there is one significant variable: the reelection of Donald Trump, a proponent of national protectionism. His promises of tariff wars—such as a declaration (or threat) of a 25% increase on Canadian and Mexican import rates, along with an additional 10% tariff on Chinese goods [4]—do not seem to be mere exaggerations. Given the volatility and instability of global politics, the potential clash between CBAM regulations and new U.S. tariff policies could significantly impact the EU and global market dynamics.

Given these circumstances, along with the diverse and complex indicators that the Forex market entails, it is crucial for financial corporations and investors—at all levels—to remain vigilant regarding present and potential changes. Acting with agility will be essential to mitigate risks and avoid potential losses.

Note3: Trump's prior dismissal of the climate crisis as a “hoax” has been referenced here as a parody.

kimeunjeong387728@gmail.com

[1] European Central Bank (ECB), Trading Economics – Eurozone Foreign Exchange Reserve Data, https://tradingeconomics.com/euro-area/foreign-exchange-reserves

[2] Filippo Taddei, Alexandre Stott, Francesco Coppola. (2024, October 14). Euro Area Fiscal Policy—Continued Consolidation and Debt Decoupling. Goldman Sachs.

[3] Reuters. (2024, November). Eurozone inflation expected to slow to 2.2% in 2024. Reuters News. Retrieved from https://www.reuters.com/eurozone-inflation-slowing-forecast

[4] Financial Times. (2024, November). Trump announces new tariff hikes on Canada, Mexico, and China. Financial Times. Retrieved from https://www.ft.com/content/trump-tariff-announcement-november